5 Steps to Create a Budget That Actually Works

Some products in this article are from our partners. Read our Advertiser Discloser.

I had someone ask me recently, “How do I put together a budget?” The question made me realize that budgeting is not a clear process.

Learning to successfully budget takes education. Also, it takes time, trial and error.

Today I’ll show you some easy steps to create a budget that actually works for you. Note that you’ll likely have to spend some time tweaking your budget – at least in the beginning.

However, in the end, you’ll have a system down that works perfectly for you. Ready?

How to Create a Budget

Creating a budget that works means you’ll have to start by following certain steps. The steps outlined here will help you get your financial budget to a place where it’s running like a well-oiled machine.

Where to start? Start by gathering all of your financial information.

1. Gather All of Your Financial Data

When you’re hitting the highway for a road trip, you need to know how to get to your destination. As you punch in your destination on your GPS, it’ll ask you one important question: Where are you starting from?

Creating a successful budget requires this same information. Once you know where you are starting from, you can figure out a path that gets you where you want to be.

Gathering all financial data includes gathering bank statements, credit card statements and bills. It also includes gathering any other paperwork that shows your monthly expenses and income.

Use paper statements you keep at home. Or check online accounts if you need to. Once you’ve gathered all of your financial data, you can move on to step 2.

2. Add Up All of Your Income and Expenses

The next step involves adding up all of your income and expense items. As far as income goes, you can write down your net pay for the month and add it up.

Of course, if you’re married, you’ll want to include any spousal income you might have. Also, don’t forget second jobs, side hustles or any other regular income sources.

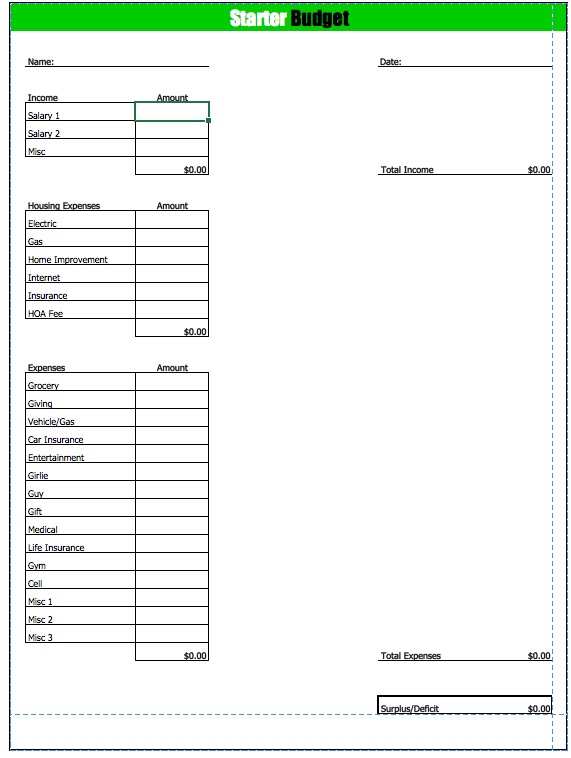

Next, you’ll want to list your monthly expenses. You might want to start by writing down your estimated expenses on a notebook pad or an Excel spreadsheet. Some examples of expenses you’ll want to include are:

- Housing expenses such as mortgage or rent payments, utility bills, cable bills, repair and maintenance bills

- Transportation costs such as car payments, gas, public transportation, car maintenance, insurance, etc.

- Basic living costs such as food and toiletries

- Personal expenses such as cell phone, entertainment, salon, gym memberships, clothing, etc.

- Family expenses such as childcare costs, pet care costs, vacation and medical costs

- Debt and loan expenses such as car loans, credit cards and student/personal loans

- The money you put into savings and other investments that aren’t pre-tax investments

And any other regular expenses that you can think of off hand. Writing your expenses down on paper or a spreadsheet is a great way to start.

However, at some point, you may want to switch to a budgeting app that makes it easier.

Managing Your Finances Online

We use an online service called Empower to track our expenses. It is a free service that links all of your financial accounts to one place. This way you can see your entire financial picture on one page.

This service takes a lot of the nitty-gritty detail work out of the equation. I no longer need to add up all of my vehicle expenses for the month.

Instead, Empower does it for me. All I need to do is go in and make sure that they get categorized correctly.

Online budgeting systems like Empower have been a game-changer for budgeting success. They allow you to save lots of time managing your money. And they help you avoid financial errors as well.

Another budgeting tool you might like is Mint. Mint is free just like Empower. However, it’s not as detailed of a site as Empower.

The next step you’ll take is to compare your incoming expenses to your outgoing expenses.

3. Compare Your Budget to Your Income

So you’ve gathered all of your financial data, and you’ve made a list of your monthly expenses. Then you’ve made a list of your income. Next, subtract your expenses from your income.

Is there money left over? Great! We’ll talk about what to do with that money in a minute. Or is there a negative number at the bottom of your statement? In other words, do you have more money going out each month than coming in?

If your monthly expenses are higher than your income, you’ll need to start tweaking your budget to cut expenses. Figure out how much money you need to cut out of your expenses to get to a zero number left over each month.

This is called zero-sum budgeting. The goal? Give every single dollar you earn a job.

How to Make a Zero-Sum Budget

The zero-sum budget works whether you don’t have enough money or have some left over each month. If you’re short, keep cutting expenses until you reach that number of zero, where income and expense are equal.

Here are some ways you may be able to cut down on your expenses:

- Reduce or eliminate entertainment or eating out expenses

- Trim your grocery budget: There are lots of ways to save money on groceries

- Trade in your expensive cars for other reliable cars with lower or no payments

- Cut out non-essentials like cable or satellite TV and gym memberships

- Find better deals on essential expenses such as auto insurance

The Challenge Everything Budget plan can be helpful for cutting expenses. With the Challenge Everything Budget, you go through every line item in your budget. You ask yourself: How can I reduce or eliminate this expense?

What if you’ve reduced your expenses as far as possible and are still coming up short? Then, it’s time to increase your income.

What if I Have Money Left Over Each Month?

Conversely, maybe you’re in a situation where you’ve got money left over each month after you add up your bills. Or maybe your budget shows you should have money left over, but your bank account doesn’t.

This is a common problem, and it’s usually the result of unplanned, unrecorded spending. Random drive-thru runs, Walmart runs and spur-of-the-moment purchases can eat up some serious cash each month.

By giving those leftover dollars a job before the month begins, you can avoid wasting money. No more tossing your money into that black hole of random spending that ruins so many people financially.

We’ll talk more about what you can do with that leftover income next. How? By talking about what your financial goals are.

4. Create Your Financial Goals

Having written financial goals is a vital part of financial success. It’s very important for you to ask yourself, “What do I want to accomplish financially?”

Do you want to have an emergency fund? Or maybe you want to save for your kid’s college or invest more for retirement.

Write down your top five or seven financial goals. Try to find some short, medium, and long-term goals.

- Short-term goals commonly take a year or less to accomplish

- Medium-term goals usually take one to five years to achieve

- Long-term goals typically take over five years to fulfill

Try to work your list so that you have two to three goals in each category. If you have a spouse, work together to plan your goals.

Talk about what’s important in your life and where you want to be in five, ten, or twenty years. Use the answers to determine your goals.

Note that this goal-setting session may take some time, and that’s okay. If you’ve never talked about goals, it’ll take some time to think about what you truly want out of life.

When doing a budget, these goals help you remember “why” you are doing one in the first place. They help you spend your money in a way that’s most important to you.

For example, let’s say you want to save for a vacation in Italy next year. Having that goal will make it much easier to avoid spending too much money on eating out.

Knowing your goals will help you stick with the budget you create. This is why this next step is equally important as the others.

5. Tweak Your Budget and Involve Your Significant Other

Many couples don’t work on budgeting together. However, this is a huge key to managing money in marriage. If your spouse isn’t involved in the budgeting process, it becomes easy for money fights to sneak into your household.

Sit down with your spouse, and as a couple, decide the amount you will budget for each category.

There will be areas where he/she will want to spend more, so be flexible. And there will be areas you will want to spend more or less in. The objective isn’t to live on as little as possible.

The objective is to have a budget that works for both you and your spouse. And at the same time, it helps you achieve your financial goals.

Having financial unity in your relationship will help avoid strife. And it will help you reach your financial goals faster. Even if you and your spouse have separate monies, discussing budgeting and money together is helpful.

Summary

Budgeting is a vital part of any successful financial plan. And by using the steps above, you can create a budget that will work for you.

Just remember that it will likely take some time and changes to get it right for you.

Hi we really want to become debt free and then and only then we can start to build wealth for our future.

The long term goal is the key in doing a budget. Thanks for the tips. Now I’m using an iPhone app to manage my monthly budget and it’s very useful so far.

I love these tips. Creating a budget is such a daunting task especially for a mom and a wife. This post surely helps a lot.

Thanks Sarah! I’m glad that you found it helpful.

Sometimes, you just need a push in the right direction to start budgeting, but it can only be helpful when you start. This is a good post. Sometimes the basics are hard to wrap your head around, too. I think it’s very important to gather your bank statements so you actually know what you’re spending.

Hey Daisy! You are right, the basics can be hard to do when you are getting started. Now that we have been doing this for a while, it is definitely easier than it used to be.

Right now my boyfriend and I do our budgets separately because we’re not married. But communication about finances is still really important since we own a place together and share expenses together. Once we’re married we’ll probably completely merge the budgets into one.

Yeah, I think you have a good strategy to keep separate budgets until you are married. However, I would make sure that you are aware of your boyfriends financial details. That way there are no surprises. 🙂

Thanks for this, Deacon. I have read many posts on creating budgets (and should probably create my own post soon) but this one hammers home the good stuff. Thanks for helping remind me!

Absolutely, Tony. I’m glad you found it helpful.

I totally agree with every point you made! And a budget doesn’t have to be fancy. I still do ours with pen and paper. We don’t even have a spreadsheet or anything! All that matters is that you make a budget and stick to it!

Sticking to it can be the hard part, but it is definitely worth it!

These are all great tips! I know of so many people who do not know how to correctly make a budget.

Thanks Michelle! It is so true, in fact, we didn’t really know how to budget when we got married. Hopefully this will give people a good place to start.